Salary ranges look simple on paper, a minimum, midpoint, and maximum for each role. But building them from scratch means navigating market data, internal equity concerns, budget constraints, and the inevitable question of what to do when half your employees don’t fit neatly into the structure you’ve created.

This guide walks through each step of establishing salary ranges, from defining your compensation philosophy to handling employees who fall outside your bands.

What are salary ranges and salary bands

Establishing salary ranges involves defining a compensation philosophy, analyzing job roles, benchmarking with market data, and creating structured pay bands with a minimum, midpoint, and maximum. The process balances internal equity with external competitiveness, helping organizations pay fairly while staying within budget.

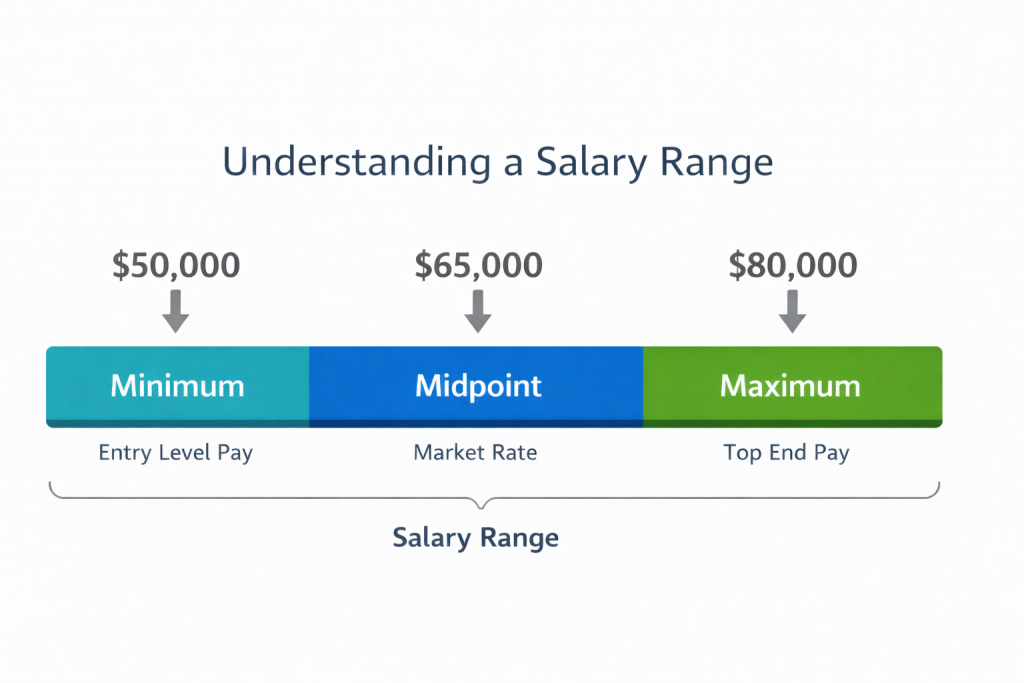

A salary range represents the pay span for a specific position. The minimum is typically what you’d offer a new hire learning the role. The midpoint reflects the market rate for someone fully competent. The maximum caps pay for top performers before they’d need a promotion to earn more.

Salary bands (also called pay bands, wage bands, or comp bands) group similar roles together at comparable pay levels. While a salary range applies to one job, a salary band might cover several related positions.

- Salary range: The min, midpoint, and max for one specific position

- Salary band: A broader grouping covering multiple roles at similar pay levels

- Range spread: The percentage gap between minimum and maximum pay

Salary bands vs pay grades vs compensation bands

You’ll hear these terms used interchangeably, though they mean slightly different things in practice.

Pay grades are numbered levels in a formal hierarchy. Think government GS levels or traditional corporate structures where Grade 7 always means the same thing. Salary bands are more flexible, typically built around market data and job families rather than rigid hierarchies. Compensation bands go beyond base pay to include bonus targets, equity grants, and sometimes benefits.

| Term | What it means | Where you’ll see it |

|---|---|---|

| Salary band | Grouped pay ranges for similar job families | Market-based structures |

| Pay grade | Numbered levels in a formal hierarchy | Government, traditional corporations |

| Compensation band | Includes base, bonus, and equity | Total rewards planning |

The terminology matters less than having a consistent framework your organization actually uses.

Why salary ranges matter for your organization

Structured pay ranges affect hiring, retention, budgeting, and legal compliance. Here’s how each piece connects.

Budget predictability and financial planning

Defined ranges let finance teams forecast labor costs accurately. When you know the ceiling for each role, modeling merit increases, promotions, and new hires becomes straightforward.

HR can make offers knowing exactly where they fall within approved parameters. No more back-and-forth with finance on whether a candidate’s ask fits the budget.

Pay equity and legal compliance

Salary bands create consistent frameworks that reduce bias in pay decisions. When every Software Engineer II falls within the same range, you have a defensible structure.

Many jurisdictions now require salary ranges in job postings. Having documented, consistently applied ranges isn’t just good practice anymore. It’s often a legal requirement.

Talent attraction and retention

Job seekers increasingly expect salary information upfront. Organizations that provide clear ranges attract more applicants and spend less time on candidates whose expectations don’t align.

For current employees, knowing their range helps them understand growth potential. They can see what’s possible in their current role and what a promotion might mean financially.

Manager decision-making consistency

Ranges give managers guardrails for offers, raises, and promotions. Instead of ad-hoc decisions that vary by department, everyone works from the same framework.

This consistency reduces situations where employees who negotiate harder end up with higher pay than equally qualified peers doing the same work.

How to establish salary ranges step by step

Each step builds on the previous one, so the sequence matters. Skipping ahead typically means backtracking later.

1. Define your compensation philosophy

Before setting any numbers, decide where your organization wants to position itself in the market. This philosophy guides every decision that follows.

- Market positioning: Lead (pay above market to attract top talent), match (pay at market median), or lag (pay below market, offset by other benefits)

- Pay mix: How much emphasis on base salary versus variable compensation like bonuses and equity

- Internal equity priority: How much weight to give tenure and internal comparisons versus external market rates

A startup competing for engineers might lead the market on equity while matching on base. A nonprofit might lag on cash but emphasize mission and flexibility.

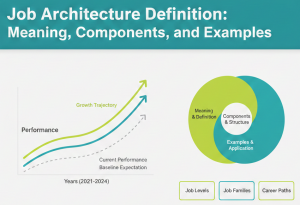

2. Organize jobs into functions and levels

Create job families (Engineering, Sales, Operations, Finance) and establish levels within each. This framework becomes the skeleton for your salary structure.

For example, an Engineering function might include: Engineer I → Engineer II → Senior Engineer → Staff Engineer → Principal Engineer.

Each level represents a meaningful step in scope and expected contribution. Startups might have 3-4 levels per function. Enterprises often have 6-8.

3. Gather market data from multiple sources

Market data forms the foundation of competitive salary ranges. Relying on a single source can skew your entire structure, so pulling from multiple inputs helps.

- Third-party compensation surveys (Radford, Mercer, Culpepper)

- Industry-specific benchmarking reports

- Internal historical compensation data

- HRIS and equity management platforms

AI-powered tools can speed this process significantly. Stello integrates market data from multiple sources and automatically matches jobs to survey benchmarks, turning weeks of manual analysis into work that happens in seconds.

4. Select benchmark positions

Not every job has clean market data. Benchmark positions are common, well-defined roles that compare easily across organizations, like “Software Engineer” or “Financial Analyst.”

Use these anchors to price your job architecture. For unique or hybrid roles, you can interpolate based on similar benchmarks or blend data from related positions.

5. Calculate range midpoints and spreads

The midpoint is your target pay rate for fully competent performers. It typically aligns to your market positioning: 50th percentile if matching market, 75th if leading.

Range spread is the percentage difference between minimum and maximum. The formula: (Maximum – Minimum) ÷ Minimum × 100.

- Entry-level roles: Narrower spreads (30-40%) since progression happens through promotion

- Senior roles: Wider spreads (50-60%) to accommodate longer tenure and expertise development

- Executive roles: Widest spreads (60%+) reflecting significant variation in scope

A common approach sets the minimum at 80-85% of midpoint and maximum at 115-120% of midpoint, creating a 40-50% range spread.

6. Assign employees to salary bands

Now map current employees into the new structure. This step often reveals uncomfortable truths. Some employees will fall below range (underpaid). Others will land above (red-circled).

Document where each person lands and flag outliers for remediation planning. This analysis also surfaces compression issues where new hires earn close to tenured employees.

7. Implement and communicate your salary structure

Rollout involves training managers on how to use ranges for offers and increases, documenting policies, and communicating to employees.

In pay-transparent environments, employees expect to know their range and where they fall within it. Clear communication builds trust. Vague explanations tend to breed suspicion.

8. Review and adjust ranges regularly

Salary structures aren’t static. Market conditions shift, inflation changes expectations, and your competitive landscape evolves.

Most organizations review ranges annually, though high-growth companies or those in competitive talent markets might adjust more frequently. AI-powered platforms can flag when ranges drift from market in real time rather than waiting for an annual review.

Salary range examples and pay band charts

Seeing a structure makes the concepts concrete. Here’s how a typical salary band chart looks across job levels:

| Level | Job title example | Range minimum | Midpoint | Range maximum |

|---|---|---|---|---|

| L1 | Analyst I | — | — | — |

| L2 | Analyst II | — | — | — |

| L3 | Senior Analyst | — | — | — |

| L4 | Lead Analyst | — | — | — |

Range spreads typically widen at higher levels. An L1 might have a 35% spread while an L4 has 50%, reflecting the longer runway for growth within senior roles.

How to handle employees outside salary ranges

Even well-designed structures create outliers. Here’s how to address each situation.

- Below range: Create a remediation plan to bring pay to minimum over 1-2 compensation cycles. Significant gaps may warrant immediate correction.

- Above range (red-circled): Freeze base increases and consider lump-sum bonuses instead. Alternatively, explore promotion paths that justify higher pay.

- Compression issues: When new hires earn close to tenured employees, address with market adjustments for existing staff rather than lowering offers.

The goal isn’t perfection on day one. It’s having a clear framework and a plan to move everyone into appropriate ranges over time.

Streamline salary range creation with AI-powered tools

Building salary ranges manually means weeks of spreadsheet work: matching jobs to surveys, calculating midpoints, modeling spreads, and identifying employee impact.

Stello’s AI Market Pricing integrates internal data with third-party market sources, automatically generates salary ranges based on level, department, and location, and scores data quality so you know how reliable your benchmarks are. The platform surfaces employee impact instantly, showing how many people fall within, above, or below each band and what adjustments would cost.

FAQs-

What is the range spread formula for salary bands?

The range spread formula is (Maximum – Minimum) ÷ Minimum × 100. This calculates the percentage difference between the lowest and highest pay in a salary band. Wider spreads allow more room for pay progression within a level.

How do you create salary ranges for global or multi-country teams?

Global salary ranges require converting compensation data across currencies and adjusting for local market rates and cost of labor. AI-powered platforms with multi-currency support (Stello handles 180+ currencies) simplify this process across regions.

What is the difference between broadbanding and traditional salary bands?

Broadbanding consolidates many narrow pay grades into fewer, wider bands. This allows greater flexibility in pay decisions and lateral movement. Traditional salary bands use more granular levels with tighter range spreads.

How do pay transparency laws affect salary range requirements?

Pay transparency laws in many jurisdictions now require employers to disclose salary ranges in job postings or upon request. Well-defined, defensible salary structures have become a compliance necessity rather than just a best practice.

Can salary bands include equity and bonus compensation?

Yes. Comprehensive compensation bands can incorporate equity (RSUs, Options, NQs, ISOs) and bonus targets alongside base salary. This approach provides a fuller picture of total compensation at each level.