Equity has become a core component of modern compensation, especially in leadership roles. Yet even experienced executives often find equity structures harder to evaluate than cash, bonuses, or benefits. The terminology is familiar, but the mechanics, trade-offs, and real value can be less obvious.

As companies use equity to attract, retain, and align leadership with long-term outcomes, understanding how stock, vesting schedules, and value creation actually work becomes a strategic necessity. Poor interpretation can lead to misaligned incentives, unexpected tax exposure, or overestimating the upside of an offer.

This article breaks down how equity functions in practice, from the forms leaders are most likely to encounter to how vesting timelines and company stage affect real value. The goal is not theory. It is clarity, so you can assess equity with the same rigor you apply to any other part of compensation.

What is equity?

Equity is ownership. More specifically, it’s the value of an ownership stake after subtracting any debts or liabilities. Whether you’re talking about a slice of a company through shares or your stake in a home after accounting for your mortgage, the core idea stays the same: equity represents what’s actually yours.

The formula is straightforward: Assets minus Liabilities equals Equity. If you sold everything and paid off every obligation, the amount left over is your equity.

Equity meaning in business and finance

In business, equity refers to ownership shares in a company. When a company sells equity, it’s exchanging a piece of itself for capital. Investors hand over cash, and in return, they get a claim on future profits and a say in how the company operates.

In personal finance, equity usually means net worth. Your home equity, for instance, is what your house is worth today minus what you still owe on the mortgage. Both uses share the same underlying math, just applied to different assets.

- Business equity: Ownership shares traded for capital to fund growth

- Personal equity: The portion of an asset you actually own after debts

How does equity work?

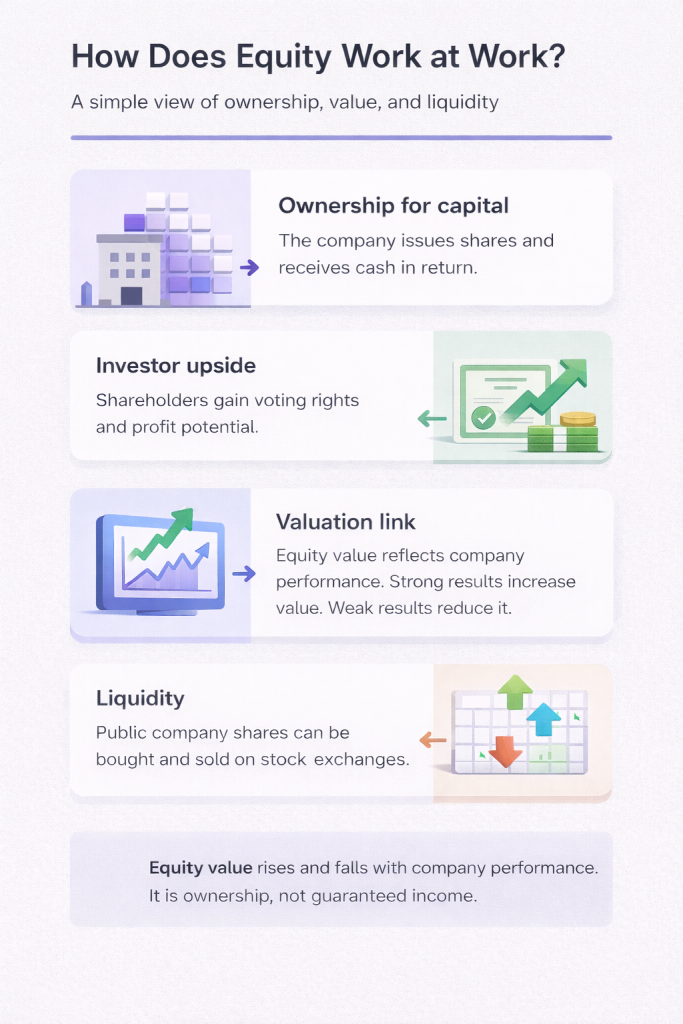

Here’s how it plays out in practice. A company decides it wants to raise money without taking on debt. So it issues shares, which are small pieces of ownership. Investors buy those shares, the company gets cash, and now those investors own a fraction of the business.

What do investors get out of it? Typically, voting rights on major decisions and a claim on profits, either through dividends or by selling their shares later at a higher price. The catch is that equity value goes up and down based on how the company performs. Good quarter? Your shares are worth more. Bad quarter? They’re worth less.

- Ownership for capital: The company issues shares and receives cash

- Investor upside: Shareholders gain voting rights and profit potential

- Valuation link: Equity value reflects company performance

- Liquidity: Public company shares can be bought and sold on stock exchanges

Types of equity-

Equity shows up in several forms, and each works a bit differently.

1. Shareholder equity

This is ownership in a corporation through stocks. Common shares typically come with voting rights, so you get a say in big company decisions. Preferred shares, on the other hand, give you priority when dividends are paid out, but usually no vote.

2. Home equity

This is the difference between your home’s current market value and what you owe on the mortgage. You build it three ways: your down payment, each principal payment you make, and any increase in your home’s value over time. If you want to access that equity, you can take out a home equity loan or open a line of credit (HELOC).

3. Private equity

This is ownership in companies that don’t trade on public stock exchanges. Venture capital funds, buyout firms, and growth investors all operate here. The trade-off? These investments are illiquid, meaning you can’t easily sell your stake whenever you want.

4. Brand equity

This one’s different. Brand equity is the intangible value that comes from a company’s reputation and customer loyalty. You can’t sell it directly, but it influences how much the company is worth overall.

What is employee equity?

Employee equity is a form of compensation where companies grant ownership stakes to attract and keep talent. It’s common at startups and growth-stage companies, though organizations of all sizes use it.

The logic is simple: when employees own a piece of the company, their success is tied to the company’s success. If the business grows in value, so does their equity.

1. Stock options

Stock options give you the right to buy company shares at a set price, called the strike price, at some point in the future. If the company’s share price rises above your strike price, you can buy at a discount and pocket the difference when you sell.

2. Restricted stock units

RSUs are grants of actual shares that you receive after meeting certain conditions, usually staying with the company for a set period. Unlike options, RSUs have value the moment they vest because you’re getting real shares, not just the right to buy them.

3. Incentive stock options

ISOs are a tax-advantaged type of stock option available only to employees. They offer favorable tax treatment if you meet specific holding requirements, though the rules are complex enough that many people consult a tax professional before exercising them.

4. Non-qualified stock options

NQSOs, sometimes called NQs, are stock options without special tax treatment. They can be granted to employees, contractors, advisors, or board members. The tax rules are more straightforward than ISOs, though typically less favorable.

| Award Type | What You Receive | When It Has Value |

|---|---|---|

| Stock Options | Right to buy shares at set price | When share price exceeds strike price |

| RSUs | Actual shares | Upon vesting |

| ISOs | Tax-advantaged options | When exercised and shares sold |

| NQSOs | Standard options | When share price exceeds strike price |

What is equity investment?

Equity investment means buying ownership stakes for potential returns. It’s different from debt investment, where you lend money and receive fixed interest payments. With equity, you own a piece of something, and your returns depend entirely on how that something performs.

When you buy stocks, you’re making equity investments. You own a fraction of each company, and if those companies do well, your investment grows. If they don’t, it shrinks. Equity funds pool money from many investors to buy diversified portfolios of stocks, spreading the risk across many companies.

How vesting works?

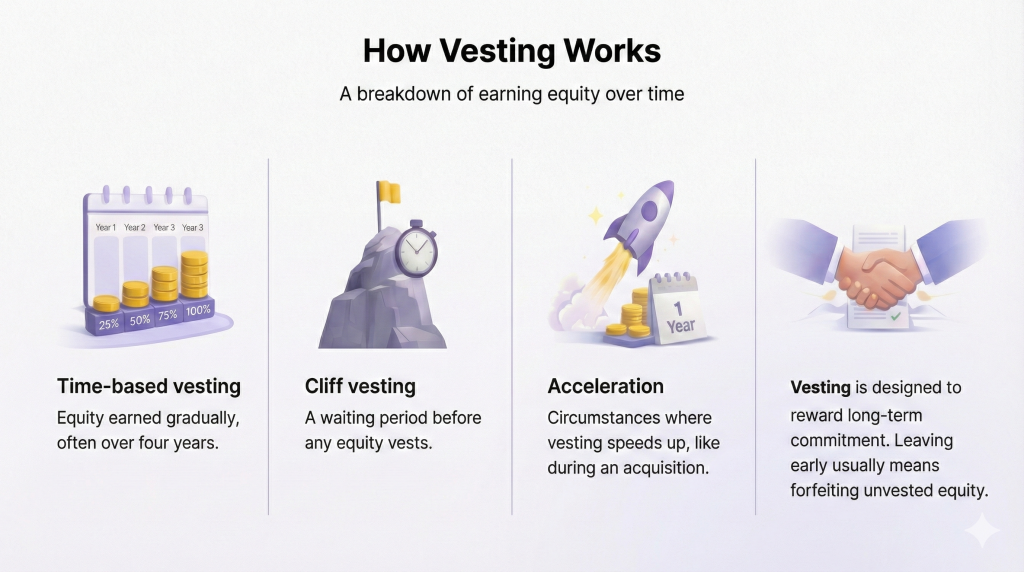

Vesting is the process of earning equity over time. Companies use vesting schedules to encourage employees to stay, since you only receive your full equity grant if you remain through the vesting period.

A typical schedule spans four years. Many companies also include a one-year cliff, which means you receive nothing if you leave before your first anniversary. After the cliff, equity usually vests monthly or quarterly until you’re fully vested.

- Time-based vesting: Equity earned gradually, often over four years

- Cliff vesting: A waiting period, commonly one year, before any equity vests

- Acceleration: Circumstances where vesting speeds up, like during an acquisition

If you leave before your equity fully vests, you forfeit the unvested portion. Only vested equity belongs to you.

How equity turns into cash?

Equity is ownership on paper until a liquidity event happens. That’s when you can actually convert your stake into money.

– Merger or acquisition

When another company buys your employer, shareholders typically receive cash, shares in the acquiring company, or some combination. For many startup employees, this is the most common path to liquidity.

– Initial public offering

An IPO is when a private company sells shares to the public for the first time. After an IPO, existing shareholders can sell on public stock exchanges, though there’s often a lock-up period of 90 to 180 days before insiders can sell.

– Secondary market sales

In some cases, shareholders can sell private company shares before an IPO through tender offers or private transactions. These opportunities are becoming more common, though they’re not available at every company.

How to calculate equity value?

The basic formula works everywhere: Assets minus Liabilities equals Equity. For a company, this calculation shows up on the balance sheet as shareholder equity.

For your personal stake in a company, the math involves two numbers: your shares and the company’s valuation.

- Company equity: Total assets minus total liabilities

- Your stake: (Your shares ÷ total shares outstanding) × company valuation

So if you own 10,000 shares in a company with 10 million shares outstanding and a $100 million valuation, your stake is worth $100,000 on paper. That value only becomes real money during a liquidity event.

Equity in stocks and the share market

When investors talk about “equities,” they usually mean stocks. Buying stocks means buying equity, or ownership, in publicly traded companies.

The share market, also called the stock market, is where ownership stakes are bought and sold. Major exchanges like the NYSE and NASDAQ handle millions of equity transactions every day, providing the liquidity that private company shares lack.

Why equity matters for compensation?

Equity compensation ties employee interests to company performance. When the company wins, employees with equity win too. This alignment is why equity has become a standard part of compensation packages, especially in technology and high-growth industries.

Managing equity awards alongside salary and bonuses creates real complexity, though. Compensation teams track multiple award types, vesting schedules, exercise windows, and valuations across the entire organization. As companies grow and expand globally, that administrative work multiplies.

Managing equity across your organization

Companies offering equity face operational challenges that grow with scale. You’re tracking grants, vesting schedules, different award types like RSUs, Options, NQs, and ISOs, plus valuations for every employee, often across multiple countries and currencies.

Compensation teams typically manage this data alongside salary, bonus, and benefits information. When compensation elements live in separate systems or spreadsheets, the annual compensation cycle becomes manual and error-prone.

Platforms like Stello let you configure all compensation elements, including all equity types, in one place, with integrations into HRIS, performance management tools, and equity administration systems. Book a demo

Frequently asked questions about equity-

1. What is the difference between equity and stock?

Equity is the broader concept of ownership. Stock is a specific type of equity representing shares in a corporation. All stock is equity, but not all equity is stock. Home equity and private company ownership are equity too.

2. How much equity do startups typically give early employees?

Early employees typically receive larger equity grants than later hires because they take on more risk joining an unproven company. Exact amounts vary based on role, company stage, and founding team philosophy.

3. What is equity dilution and how does it affect ownership?

Dilution happens when a company issues new shares, reducing each existing shareholder’s percentage ownership. Your slice of the pie gets smaller, though the pie itself may grow in value if the new funding increases company valuation.

4. Is equity compensation taxed differently than salary?

Yes. Equity compensation has different tax treatment depending on the award type, when you exercise options, and how long you hold shares. The rules vary significantly between ISOs, NQSOs, and RSUs.

5. Can employees lose unvested equity when leaving a company?

Yes. Unvested equity is typically forfeited when an employee leaves before completing the vesting schedule. Only vested equity belongs to you, and even then, stock options often have a limited exercise window after departure.