Compensation management has evolved beyond basic salary benchmarking. Enterprises today must balance pay equity, global complexity, and transparent pay practices — while staying competitive in tight talent markets.

Payscale remains a widely used compensation tool, but as organizations scale, many outgrow its flexibility, depth, or cost structure. Gaps often appear around global data coverage, job architecture, equity insights, or strategic modeling.

That’s why HR, People Ops, and Finance leaders are increasingly exploring Payscale alternatives. Modern compensation platforms offer richer market data, stronger pay equity tools, and better alignment with business strategy. This guide covers the best Payscale alternatives to help you choose the right fit for your compensation needs.

What Is Payscale?

Payscale is a compensation management and salary benchmarking platform that helps organizations price roles using market data. It’s widely used by HR and People teams to benchmark salaries, create pay ranges, and support compensation planning.

At its core, Payscale relies on survey-based data collected from employers and employees, combined with proprietary models, to provide market pay insights across roles, industries, and locations.

What Payscale is commonly used for

- Salary benchmarking and market pricing

- Creating and maintaining pay ranges

- Compensation planning and adjustments

- Supporting pay transparency initiatives

Why companies start with Payscale

- Easy-to-use interface

- Broad role coverage

- Faster setup compared to enterprise survey providers

- Suitable for early-to-mid-stage compensation programs

Where Payscale can fall short

- Limited flexibility for complex job architectures

- Challenges scaling across global or highly specialized roles

- Less support for real-time scenario modeling

- Can become cost-prohibitive as organizations grow

As compensation programs mature, many enterprises find they need tools that go beyond benchmarking — driving the shift toward more advanced Payscale alternatives.

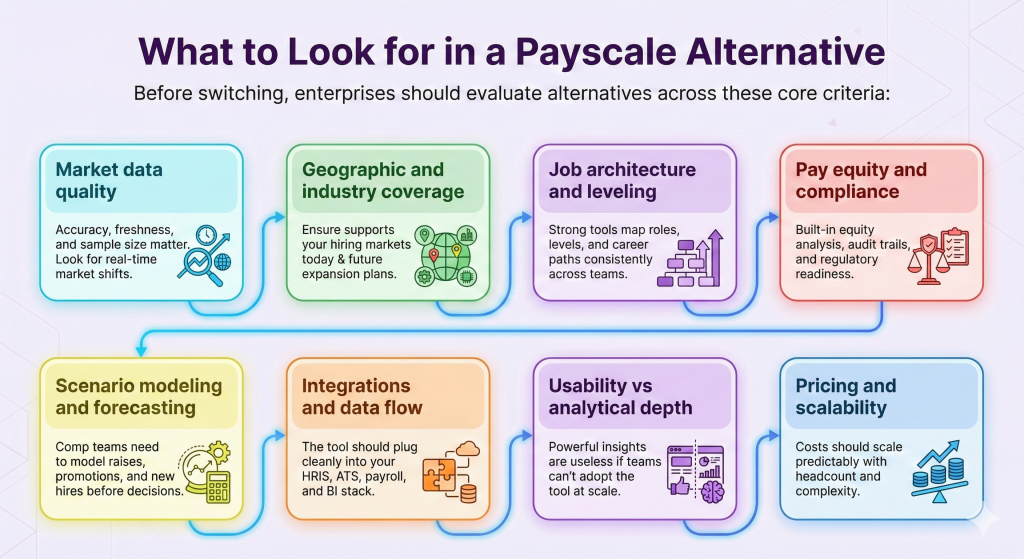

What to Look for in a Payscale Alternative

Not all compensation tools solve the same problems. Before switching, enterprises should evaluate alternatives across these core criteria:

Market data quality

Accuracy, freshness, and sample size matter. Look for data that reflects real-time market shifts, not annual snapshots.

Geographic and industry coverage

Ensure the platform supports your hiring markets today — and where you plan to expand next.

Job architecture and leveling

Strong tools map roles, levels, and career paths consistently across teams and regions.

Pay equity and compliance

Built-in equity analysis, audit trails, and regulatory readiness are no longer optional.

Scenario modeling and forecasting

Comp teams need to model raises, promotions, and new hires before decisions go live.

Integrations and data flow

The tool should plug cleanly into your HRIS, ATS, payroll, and BI stack.

Usability vs analytical depth

Powerful insights are useless if teams can’t adopt the tool at scale.

Pricing and scalability

Costs should scale predictably with headcount and complexity.

Best Payscale Alternatives for Compensation Management

1. Stello

Best for: Enterprises building modern, data-driven compensation programs

Stello is designed for organizations that want to move beyond static benchmarking and manage compensation as a strategic business lever. Unlike Payscale’s survey-first approach, Stello focuses on connecting market data, internal structures, and real compensation decisions in one system.

Why Stello stands out

- Compensation-first platform built for scale

- Strong alignment between job architecture, leveling, and pay bands

- Clear visibility across cash, equity, and total rewards

- Designed for ongoing decision-making — not one-off benchmarking

Key strengths

- Market-informed pay ranges mapped to internal roles

- Scenario modeling for promotions, raises, and new hires

- Pay equity insights baked into workflows

- Enterprise-ready reporting for HR and Finance leaders

Limitations

- Not a traditional survey vendor, which may require a mindset shift for teams used to legacy benchmarking tools

Ideal use cases

- Mid-to-large enterprises modernizing compensation strategy

- Organizations scaling globally with structured role frameworks

- Teams prioritizing transparency, equity, and decision velocity

2. Radford

Best for: Large enterprises with mature, global compensation programs

Radford (by Aon) is one of the most established names in compensation benchmarking, especially for technology, life sciences, and high-growth enterprises. It’s often chosen by organizations that need deep, defensible market data to support executive and board-level pay decisions.

Why Radford stands out

- Highly trusted survey data with strong market credibility

- Extensive global coverage across roles, levels, and industries

- Well-suited for complex, multinational organizations

Key strengths

- Detailed salary, incentive, and equity benchmarks

- Strong job matching and leveling rigor

- Widely accepted by finance leaders, boards, and investors

- Reliable for long-term compensation governance

Limitations

- Expensive and survey-heavy

- Less flexible for real-time modeling or rapid changes

- Requires internal expertise to operationalize effectively

Ideal use cases

- Large enterprises with established comp teams

- Organizations needing board-ready compensation data

- Companies prioritizing data defensibility over speed

3. Syndio

Best for: Pay equity, fairness, and regulatory readiness

Syndio is a specialized compensation tool focused on identifying and addressing pay gaps. While it doesn’t replace market benchmarking tools like Payscale, it plays a critical role in ensuring compensation decisions are fair, explainable, and compliant.

Why Syndio stands out

- Pay equity and bias detection at scale

- Strong auditability and documentation

- Designed for legal and regulatory scrutiny

Key strengths

- Statistical pay gap analysis

- Scenario testing before comp changes go live

- Clear reporting for HR, Legal, and Leadership

- Supports global pay equity requirements

Limitations

- Not a full compensation management platform

- Requires clean internal data to be effective

- Typically paired with benchmarking tools

Ideal use cases

- Enterprises prioritizing pay equity and transparency

- Organizations preparing for audits or regulation

- Teams adding an equity layer to existing comp systems

4. Carta

Best for: Companies with equity-first or equity-heavy compensation structures

Carta is widely used for equity management and cap table administration, making it a strong complement — and partial alternative — to Payscale for organizations where equity is a major component of total rewards.

Why Carta stands out

- Best-in-class equity and ownership management

- Clear visibility into employee equity alongside cash compensation

- Strong trust among founders, finance teams, and investors

Key strengths

- Equity grants, vesting, and cap table management

- Total rewards visibility when paired with salary data

- Scenario modeling for equity compensation

- Compliance support for equity-related regulations

Limitations

- Not a full salary benchmarking replacement

- Limited job architecture and market pricing depth

- Often used alongside, not instead of, comp benchmarking tools

Ideal use cases

- Startups and scaleups with significant equity compensation

- Tech-forward organizations balancing cash and equity

- Finance-led teams managing complex ownership structures

5. Comptryx

Best for: Mid-market organizations seeking reliable compensation benchmarking

Comptryx focuses on delivering market pricing and benchmarking data for organizations that need structure without the heavy cost or complexity of enterprise survey providers.

Why Comptryx stands out

- Straightforward access to compensation survey data

- Practical benchmarking for common roles

- Suitable for teams without large, dedicated comp functions

Key strengths

- Salary surveys across multiple industries

- Market pricing and pay range development

- Reporting tools for compensation planning

- Lower barrier to entry than enterprise-heavy providers

Limitations

- Less robust global coverage

- Limited advanced modeling and forecasting

- UI and integrations can feel dated

Ideal use cases

- Mid-sized companies building formal compensation programs

- Teams transitioning from ad-hoc salary decisions

- Organizations prioritizing simplicity over deep analytics

Payscale vs Top Alternatives: Comparison Table

| Tool | Primary Focus | Market Data Depth | Job Architecture | Pay Equity & Compliance | Scenario Modeling | Best For |

| Payscale | Salary benchmarking | Medium | Basic | Limited | Limited | Small–mid teams starting comp programs |

| Stello | End-to-end compensation management | High (market-informed) | Strong | Built-in | Strong | Enterprises running ongoing comp decisions |

| Radford (Aon) | Survey-based benchmarking | Very High | Very Strong | Governance-led | Limited | Large global enterprises |

| Mercer | Total rewards strategy | Very High | Very Strong | Strong | Limited | Highly regulated, complex orgs |

| Carta | Equity compensation | Low (salary) | Limited | Equity-focused | Medium | Equity-heavy companies |

| Comptryx | Salary benchmarking | Medium | Basic | Limited | Limited | Mid-market orgs |

| Salary.com | Structured compensation | Medium–High | Strong | Strong | Limited | Compliance-driven enterprises |

| Syndio | Pay equity analysis | N/A | Internal-data based | Very Strong | Medium | Equity & audit readiness |

Conclusion

Payscale remains a solid entry point for salary benchmarking, but compensation management today requires more than market data alone. As organizations scale, expand globally, and prioritize pay equity, the limits of survey-first tools become more apparent.

The best Payscale alternatives differ in focus — from end-to-end compensation management platforms like Stello, to enterprise survey providers like Radford and Mercer, to specialized tools for equity and compliance. The right choice depends on your compensation maturity, workforce complexity, and how closely pay decisions need to align with business strategy.

Ultimately, compensation is no longer a once-a-year exercise. Enterprises that treat it as an ongoing, data-driven process — supported by the right tools — are better positioned to attract, retain, and reward talent fairly and competitively.

FAQs-

1. What is the best alternative to Payscale for enterprises?

The best alternative depends on your compensation maturity. Enterprises managing ongoing pay decisions often choose platforms like Stello, while large global organizations may prefer survey-heavy providers like Radford or Mercer for defensible market data.

2. Why do companies move away from Payscale?

Organizations often outgrow Payscale as they scale globally or need deeper job architecture, pay equity analysis, and scenario modeling. Cost, flexibility, and limited real-time decision support are also common reasons.

3. Is Payscale enough for global compensation management?

Payscale can work for smaller or early-stage programs, but global enterprises typically require tools with stronger international data coverage, governance controls, and region-specific compliance support.

4. Do I need more than one compensation tool?

In many cases, yes. Enterprises often combine a core compensation management platform with specialized tools for equity management or pay equity analysis, depending on their compensation structure and regulatory needs.