Compensation has evolved from an HR function to a strategic control system — directly impacting profitability, talent retention, regulatory risk, and organizational trust.

As enterprises scale, compensation complexity compounds. Multiple pay components. Layered approvals. Rising scrutiny on equity and transparency. Finance expects budget discipline and forecast accuracy.

Yet most organizations still rely on spreadsheets, fragmented systems, or legacy platforms never built for this complexity. The cost: delayed cycles, limited visibility, compliance exposure, and decisions made without financial context.

This is why compensation management has become a board-level priority.

Today’s executive teams need systems that integrate governance, intelligence, and execution — platforms that align pay strategy with business outcomes, empower managers without losing control, and ensure every decision withstands financial and regulatory scrutiny.

This guide examines the leading enterprise compensation management platforms and what separates operational tools from strategic systems.

Why Enterprise Compensation Management Is a Strategic Priority

For enterprise leadership, compensation is one of the largest controllable investments on the balance sheet. It directly influences operating margins, workforce productivity, and long-term talent strategy. Yet it remains one of the least structurally governed processes in many organizations.

As enterprises grow, compensation decisions move beyond annual merit cycles. They become continuous, distributed, and highly visible — touching multiple stakeholders across HR, Finance, Legal, and business leadership.

Growing Pay Complexity in Large Organizations

Enterprise compensation environments are inherently complex. This complexity compounds as organizations scale.

- Multiple compensation components across roles and regions

- Global pay structures with local regulatory constraints

- Variable pay tied to performance, incentives, and business outcomes

- Equity and long-term incentives layered on top of cash compensation

What was once manageable at a smaller scale becomes structurally ungovernable without the right systems.

Why Spreadsheets and Legacy Systems Fail at Scale

Most enterprises did not intentionally choose broken compensation processes — they inherited them.

Spreadsheets and legacy HR modules struggle to support:

- Real-time budget visibility across departments

- Consistent application of compensation rules

- Audit-ready decision trails

- Secure, role-based access for managers

As a result, leadership teams face delayed cycles, reconciliation issues, and limited confidence in compensation outcomes — often after decisions have already been communicated.

Compensation as a Finance and HR Alignment Problem

At enterprise scale, compensation failure is rarely an HR issue alone. It is an alignment failure between Finance and HR.

- Finance needs predictability, controls, and forecast accuracy

- HR needs flexibility, speed, and manager enablement

- Leadership needs assurance that decisions align with strategy

Without a unified compensation management framework, organizations are forced to trade speed for control — or control for agility. Neither is acceptable at the enterprise level.

This tension is precisely why compensation management has shifted from an operational task to a strategic leadership priority.

What to Look for in an Enterprise Compensation Management Tool

Enterprise leaders do not evaluate compensation technology the same way they evaluate HR software. The stakes are higher. The risks are financial, regulatory, and reputational. The right platform must operate as a control system, not just a workflow layer.

Before comparing tools, leadership teams should align on the capabilities that matter at enterprise scale.

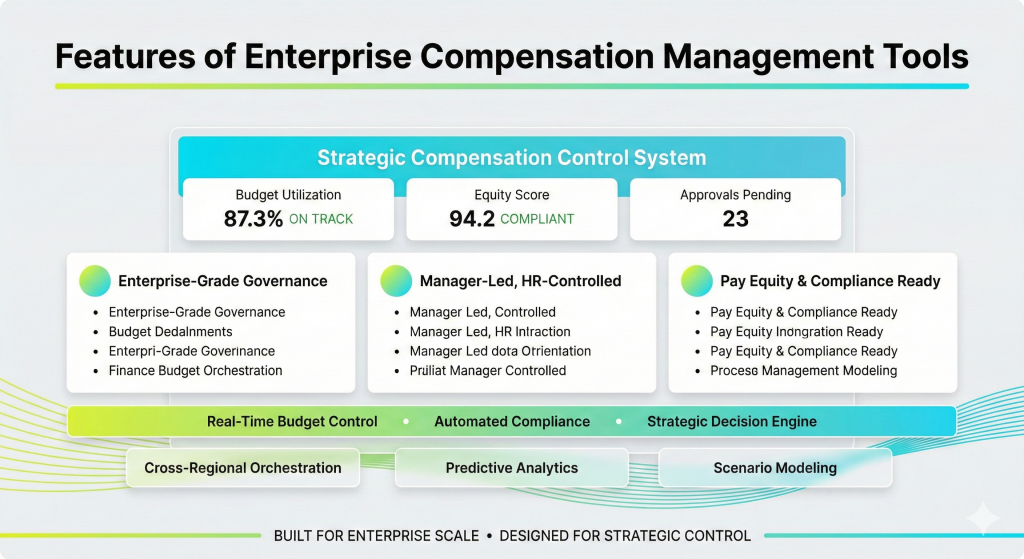

– Enterprise-Grade Governance and Budget Control

Compensation decisions must operate within clearly defined financial boundaries.

An enterprise-ready platform should:

- Enforce centrally approved budgets across teams and regions

- Prevent over-allocation in real time, not after the fact

- Support multi-level approvals aligned to governance structures

- Provide finance leaders continuous visibility into compensation spend

Without embedded controls, compensation planning becomes reactive — forcing last-minute adjustments and eroding trust in the process.

– Manager-Led, HR-Controlled Compensation Planning

Modern enterprises cannot centralize every compensation decision. Managers must be empowered — but never unconstrained.

The right tool enables:

- Guided manager workflows with predefined guardrails

- Role-based access that limits risk without slowing decisions

- Consistent application of compensation policies across the organization

This balance allows HR to scale without becoming a bottleneck, while ensuring leadership retains oversight and accountability.

– Pay Equity, Compliance, and Reporting Readiness

Pay decisions are now subject to greater scrutiny than ever before.

Enterprise compensation platforms must:

- Surface pay equity risks before decisions are finalized

- Maintain audit-ready trails for every change and approval

- Support compliance with evolving pay transparency regulations

- Enable leadership to defend decisions with data, not assumptions

At scale, compliance cannot be an afterthought — it must be built into the system.

Top 10 Enterprise Compensation Management Tools

Enterprise leaders evaluating compensation platforms are not looking for incremental improvements. They are looking for control, scalability, and confidence — systems that can support complex pay decisions without slowing the organization down.

Below is an overview of the leading enterprise compensation management tools, starting with the platform built specifically for this level of complexity.

1. Stello — Enterprise Compensation Intelligence & Decision Platform

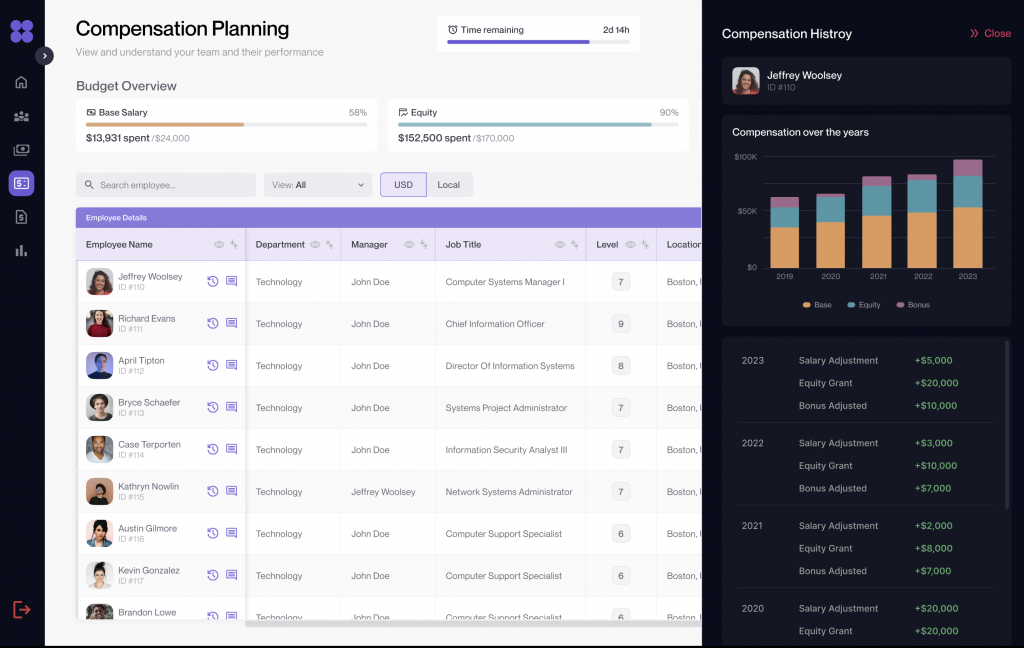

Stello is an AI-powered enterprise compensation management platform that connects performance signals to compensation decisions, budgeting, and governance at scale. It goes beyond traditional compensation tools by unifying salary, bonus, equity, and incentive planning into one intelligent workflow—giving leaders real-time visibility into spend and outcomes.

Stello’s strength lies in its ability to help enterprises make data-driven, defensible pay decisions across thousands of employees and complex org structures. It eliminates manual work, reduces reliance on spreadsheets, and builds a decision-intelligence layer between HR, Finance, and business leadership.

Best for: Enterprises that must tie performance to compensation decisions, enforce financial controls, and maintain audit-ready governance.

Key Features

- Real-Time Compensation Budget Visibility: Track budget planning, compensation spend, and forecasts across teams and geographies without manual consolidation.

- Centralized Pay Elements Management: Configure and manage all pay components — base salary, bonuses, equity (RSUs, options), incentives, and proration — within a single system.

- AI-Guided Recommendations: AI-powered guidance to shape compensation strategy, optimize decisions, and align outcomes with performance and market context.

- Integration with Enterprise Systems: Seamless data flow with HRIS, payroll, benefits, and performance tools, ensuring consistency and accuracy.

- Employee Compensation Statements: Generate clear compensation statements that explain pay determinations, boosting transparency and trust.

Pros

- Ties performance insights directly to compensation outcomes and planning.

- Real-time governance and transparency for large, complex enterprises.

- Flexible modeling across diverse compensation structures.

Cons

- As a specialized platform, public third-party reviews and broad adoption benchmarks can be limited.

- Shift from legacy systems and spreadsheets requires executive alignment and change management.

2. Workday Compensation

Workday Compensation is part of the broader Workday HCM suite and is most often adopted by enterprises that have already standardized on Workday for core HR operations. It provides a centralized environment for managing merit increases, bonuses, and stock grants within existing HR workflows.

For leadership teams, Workday’s primary value lies in system consolidation rather than compensation specialization. It brings compensation planning closer to employee data and performance records, but relies heavily on predefined workflows and configurations.

Best for: Large enterprises already deeply embedded in the Workday ecosystem and prioritizing suite-wide consistency over compensation-specific flexibility.

Key Features

- Native HCM Integration: Compensation planning tied directly to employee profiles, performance data, and organizational structures.

- Standardized Merit and Bonus Cycles: Prebuilt workflows for annual and off-cycle compensation planning.

- Global Compensation Frameworks: Support for multi-country compensation structures and currencies.

- Reporting and Dashboards: Standard reports for leadership visibility and compliance needs.

Pros

- Seamless integration with Workday HCM and talent modules

- Familiar interface for organizations already using Workday

- Strong global HR data foundation

Cons

- Limited flexibility for complex or non-standard compensation models

- Heavy configuration effort for advanced use cases

- Compensation capabilities are constrained by broader HCM architecture

3. SAP SuccessFactors Compensation

SAP SuccessFactors Compensation is part of SAP’s broader HXM suite and is commonly used by large, global enterprises with complex organizational structures and regulatory requirements. It supports merit increases, bonuses, and long-term incentives within SAP’s standardized HR framework.

For leadership teams, SuccessFactors offers global scale and compliance coverage, particularly in highly regulated industries. However, compensation planning often requires significant configuration and ongoing administrative effort to adapt to evolving business needs.

Best for: Global enterprises already invested in SAP infrastructure and prioritizing compliance and standardization over speed and flexibility.

Key Features

- Global Compensation Frameworks: Supports multi-country compensation planning with local regulatory considerations.

- Merit, Bonus, and LTI Planning: Configurable templates for different compensation cycles.

- Role-Based Permissions: Structured access controls aligned with enterprise governance models.

- SAP Ecosystem Integration: Tight integration with SAP HR, payroll, and finance systems.

Pros

- Well-suited for large, multinational organizations

- Strong compliance and localization capabilities

- Deep integration with SAP ERP and HR systems

Cons

- Complex configuration and longer setup timelines

- Less intuitive manager experience

- Slower to adapt to non-standard or evolving compensation models

4. Oracle HCM Compensation

Oracle HCM Compensation is part of the Oracle Cloud HCM suite and is typically adopted by enterprises already running Oracle for ERP, finance, or HR operations. It supports salary, bonus, and incentive planning within Oracle’s enterprise-grade data and security framework.

For leadership teams, Oracle’s compensation module offers scale and reporting depth, particularly where tight alignment with financial systems is a priority. However, compensation planning is often constrained by system rigidity and usability challenges for managers.

Best for: Enterprises standardized on Oracle Cloud that value deep ERP alignment and centralized reporting.

Key Features

- Integrated Compensation Planning: Salary, bonus, and incentive planning within Oracle HCM workflows.

- Enterprise Reporting: Strong analytics and reporting tied to Oracle’s data architecture.

- Role-Based Security: Granular access controls aligned with enterprise governance.

- ERP Alignment: Direct linkage between compensation data and financial systems.

Pros

- Tight integration with Oracle ERP and finance systems

- Strong reporting and data governance capabilities

- Suitable for very large enterprises

Cons

- Manager experience can be complex and unintuitive

- Limited flexibility for dynamic compensation models

- Longer implementation and change cycles

5. PayScale

PayScale is primarily a compensation data and market pricing platform rather than a full enterprise compensation management system. It is widely used by enterprises to benchmark roles, analyze market competitiveness, and inform pay decisions using external salary data.

For leadership teams, PayScale’s value lies in pricing intelligence, not execution. It helps organizations understand how their compensation compares to the market but does not manage end-to-end compensation planning or governance.

Best for: Enterprises that need reliable market benchmarking data to inform compensation strategy, not execute compensation cycles.

Key Features

- Salary Benchmarking: Market-based pricing for roles across industries and geographies.

- Compensation Insights: Pay range development and market competitiveness analysis.

- Job Architecture Support: Tools to align internal roles with external market data.

- Reporting and Analytics: Data-driven insights to support pay decisions.

Pros

- Strong, widely trusted compensation data

- Useful for pricing and benchmarking at scale

- Complements enterprise compensation platforms

Cons

- Not an execution or planning system

- Limited workflow, governance, and budget controls

- Requires integration with other tools for full compensation management

6. Mercer WIN

Mercer WIN is a compensation and total rewards platform typically deployed as part of a broader consulting-led engagement. It combines Mercer’s job architecture, market pricing data, and advisory expertise with supporting technology to help enterprises design and manage compensation frameworks.

For leadership teams, Mercer WIN is best viewed as a strategy and design enabler rather than a fast, self-service execution platform. It excels in structuring compensation philosophy but often relies on additional systems for day-to-day planning and payouts.

Best for: Enterprises seeking expert-led compensation design and market alignment, especially during transformation or restructuring initiatives.

Key Features

- Job Architecture and Market Pricing: Access to Mercer’s global compensation data and role frameworks.

- Compensation Design Tools: Support for salary structures, grades, and pay ranges.

- Total Rewards Modeling: Tools to evaluate reward mix across roles and geographies.

- Advisory Integration: Direct linkage between consulting insights and system outputs.

Pros

- Deep compensation and rewards expertise

- Strong market data and benchmarking

- Credibility with boards and regulators

Cons

- Less suited for rapid, manager-led execution

- Slower cycles compared to product-led platforms

- Often requires complementary systems for full compensation management

7. Anaplan

Anaplan is a connected planning platform used by enterprises to model complex financial and operational scenarios, including compensation. It is not a dedicated compensation product, but it is often configured to support compensation planning as part of broader workforce and financial planning initiatives.

For leadership teams, Anaplan’s strength lies in scenario modeling and forecasting, not in day-to-day compensation execution. It provides flexibility, but that flexibility comes at the cost of complexity and ongoing administrative effort.

Best for: Enterprises that require advanced compensation modeling tightly linked to financial planning and already operate Anaplan as a core planning platform.

Key Features

- Scenario and What-If Modeling: Model compensation outcomes under different budget and workforce assumptions.

- Connected Planning: Link compensation planning with workforce, revenue, and cost models.

- Custom Configuration: Highly configurable logic to reflect unique compensation structures.

- Enterprise Reporting: Roll-ups and forecasts for leadership review.

Pros

- Powerful modeling and forecasting capabilities

- Strong alignment with enterprise financial planning

- Highly flexible for complex scenarios

Cons

- Not purpose-built for compensation execution

- Requires significant configuration and specialist support

- Limited manager-friendly workflows

8. beqom

beqom is a global compensation and total rewards platform designed to support complex, multinational compensation programs. It focuses on managing base pay, bonuses, long-term incentives, and sales compensation within a single system.

For leadership teams, beqom offers breadth across compensation types, particularly for organizations operating across many countries. However, its depth and configurability can introduce complexity for both administrators and managers.

Best for: Large, global enterprises with diverse compensation programs and a need for centralized total rewards management.

Key Features

- End-to-End Compensation Management: Base salary, bonuses, long-term incentives, and sales compensation.

- Global Scalability: Multi-country, multi-currency support with localized rules.

- Governance and Controls: Approval workflows and audit trails for compensation decisions.

- Analytics and Reporting: Dashboards for compensation outcomes and spend analysis.

Pros

- Broad compensation and total rewards functionality

- Strong support for global enterprises

- Centralized governance and reporting

Cons

- Steeper learning curve for users

- Configuration-heavy for complex environments

- Slower adoption compared to more focused platforms

9. Lattice Compensation

Lattice Compensation is an extension of Lattice’s performance management platform and is designed to help organizations connect performance reviews with compensation decisions. It is commonly used by fast-growing companies that want to formalize pay decisions without heavy enterprise complexity.

For leadership teams, Lattice offers simplicity and manager engagement, but it is not built to handle the scale, governance, or financial rigor required by large enterprises.

Best for: Mid-sized organizations or growing teams prioritizing performance-led compensation over complex enterprise controls.

Key Features

- Performance-Linked Compensation: Ties compensation decisions directly to performance reviews.

- Manager-Friendly Workflows: Simple interfaces for planning and approvals.

- Compensation Bands: Support for basic salary bands and increase guidelines.

- HR Visibility: Centralized view of compensation decisions.

Pros

- Strong integration with performance management

- Intuitive user experience

- Quick to deploy

Cons

- Limited budget controls and financial modeling

- Not designed for large, complex enterprises

- Lacks advanced governance and compliance features

10. ADP Compensation

ADP Compensation tools are typically used alongside ADP payroll systems and focus on enabling compensation adjustments within a payroll-centric environment. They are most valuable for organizations seeking continuity between compensation changes and payroll execution.

For leadership teams, ADP’s strength lies in operational reliability, not strategic compensation planning. Advanced modeling, scenario analysis, and enterprise governance often require additional tools.

Best for: Organizations that prioritize payroll integration and operational execution over strategic compensation planning.

Key Features

- Payroll-Linked Compensation Changes: Direct connection between compensation decisions and payroll execution.

- Basic Compensation Planning: Support for salary increases and bonuses.

- Reporting: Standard reports for compensation changes and payroll impact.

- Compliance Support: Alignment with payroll compliance requirements.

Pros

- Strong payroll integration

- Reliable execution at scale

- Broad market adoption

Cons

- Limited strategic planning capabilities

- Minimal scenario modeling and governance

- Not designed as a standalone enterprise compensation platform

Enterprise Compensation Management Tools – Comparison Table

| Tool | Best For | Core Strengths | Key Limitations |

| Stello | Large enterprises with complex, multi-entity compensation | Purpose-built for enterprise compensation; real-time budget control; governed manager workflows; pay equity and audit readiness | Not designed for SMBs (enterprise focus by design) |

| Workday Compensation | Workday-first enterprises | Native HCM integration; centralized HR data | Rigid workflows; limited flexibility for complex pay models |

| SAP SuccessFactors Compensation | Global enterprises on SAP | Strong compliance and localization; SAP ecosystem alignment | Heavy configuration; slower cycles; lower manager usability |

| Oracle HCM Compensation | Oracle-standardized enterprises | Deep ERP and finance integration; strong reporting | Complex UI; limited agility; longer implementations |

| PayScale | Market pricing and benchmarking | Trusted salary data; market competitiveness insights | Not an execution or planning platform |

| Mercer WIN | Consulting-led compensation design | Job architecture expertise; global market data | Slower execution; often needs additional systems |

| Anaplan | Advanced modeling and forecasting | Powerful scenario planning; financial alignment | Not purpose-built; heavy configuration; limited manager workflows |

| beqom | Global total rewards programs | Broad compensation coverage; global scalability | Steep learning curve; configuration complexity |

| Lattice Compensation | Performance-led, mid-sized orgs | Strong manager experience; fast adoption | Limited enterprise controls and financial governance |

| ADP Compensation | Payroll-centric environments | Reliable payroll execution; compliance support | Minimal strategic planning; limited compensation intelligence |

Conclusion

Enterprise compensation is no longer a periodic HR exercise. It is a continuous leadership responsibility with direct implications for financial performance, regulatory risk, and organizational trust.

As this comparison shows, many tools address parts of the compensation challenge — benchmarking, modeling, payroll execution, or HR process alignment. Few are designed to govern compensation decisions end to end at enterprise scale.

For leadership teams, the differentiator is not feature breadth. It is control. Control over budgets. Control over decision consistency. Control over equity, transparency, and auditability — without sacrificing speed.

This is where Stello stands apart. It is built specifically for enterprises that treat compensation as a strategic lever, not an operational afterthought. By unifying planning, governance, and execution in a single system, Stello enables leaders to make confident, defensible pay decisions at scale.

In an environment where compensation decisions are increasingly visible and consequential, the right platform is not just a technology choice — it is a leadership decision.

FAQs-

What makes enterprise compensation management different from standard HR compensation tools?

Enterprise compensation management goes beyond basic salary planning. It requires real-time budget control, multi-entity governance, pay equity oversight, and audit readiness across thousands of employees. Most standard HR tools focus on process consistency, not financial and regulatory control at scale.

Why do large enterprises move away from spreadsheets for compensation planning?

Spreadsheets lack version control, audit trails, and preventive budget controls. At enterprise scale, this leads to delayed cycles, reconciliation issues, and increased compliance risk. Purpose-built platforms provide a single source of truth and enforce policy before decisions are finalized.

How should CXOs evaluate enterprise compensation management tools?

Leadership teams should prioritize financial governance and budget visibility, manager autonomy with HR and Finance guardrails, pay equity and compliance capabilities, and scalability across regions and compensation types. The objective is not just efficiency, but decision confidence.

Why is Stello positioned as a first-choice platform for enterprises?

Stello is purpose-built for enterprise compensation complexity. It unifies planning, governance, and execution in one system — giving leaders control, transparency, and speed without relying on fragmented tools or manual processes.