Salary ranges are a core control mechanism in compensation strategy. They define the financial boundaries within which talent is hired, rewarded, and retained, while protecting cost discipline and internal equity.

For CFOs, salary ranges are not just HR constructs. They directly influence workforce cost planning, margin stability, compliance risk, and long-term talent sustainability. When designed well, they bring predictability to payroll spend. When poorly defined, they create pay compression, attrition risk, and governance gaps.

This article explains what salary ranges are, how they are structured, and how CFOs can interpret and apply them effectively using practical examples.

What Are Salary Ranges?

A salary range is the predefined minimum and maximum compensation an organization is willing to pay for a specific role, job level, or position within its workforce.

Rather than assigning a single fixed salary, organizations use salary ranges to create controlled flexibility in pay. This allows compensation to vary based on experience, performance, skill depth, and market conditions, while staying within approved cost boundaries.

From a finance perspective, salary ranges act as guardrails. They help standardize pay decisions, support workforce budgeting, and reduce the risk of ad hoc or inconsistent compensation outcomes across teams.

In practice, salary ranges are applied across hiring offers, promotions, merit increases, and internal pay progression to ensure compensation remains aligned with both market benchmarks and internal equity goals.

Also read: Components of Compensation: A Complete Breakdown for Employers

Meaning of Salary Ranges in Compensation

In compensation strategy, a salary range represents the approved pay envelope for a role based on its relative value to the organization and the external market.

It translates job architecture, market pricing, and internal equity into an executable pay framework. Each role is positioned within a range to reflect differences in capability, impact, and progression, without redefining the role itself.

For CFOs, the meaning of salary ranges is operational and financial. They provide a mechanism to control payroll growth, forecast compensation spend, and maintain consistency across functions and geographies. Salary ranges also enable disciplined decision-making during hiring, promotions, and annual increments.

Most importantly, salary ranges separate role value from individual pay. This distinction helps organizations reward performance and experience without distorting the underlying compensation structure or creating long-term cost imbalances.

Components of a Salary Range

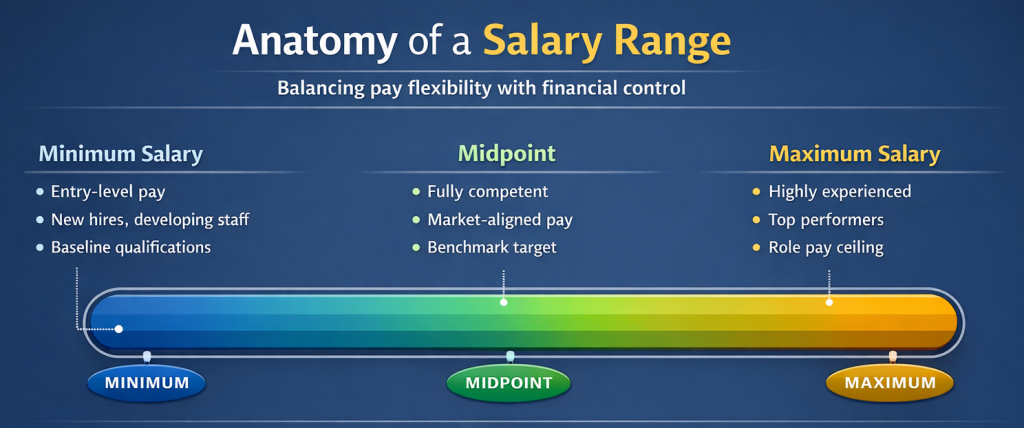

A salary range is typically built around three core components. Each plays a specific role in maintaining pay discipline and flexibility.

Minimum salary

The minimum represents the lowest compensation the organization is willing to pay for the role. It is usually aligned to entry-level qualifications, limited experience, or a learning curve phase. Paying below the minimum often signals misalignment with market or role expectations.

Midpoint

The midpoint reflects the market-aligned or target pay for a fully competent employee in the role. It is the anchor for most compensation decisions and is often used as a reference point for budgeting, merit increases, and internal comparisons.

Maximum salary

The maximum defines the upper limit of compensation for the role. It typically applies to highly experienced or consistently high-performing employees. Exceeding the maximum can create pay compression, limit future growth, and increase long-term fixed costs.

Together, these components create a structured yet flexible framework that supports consistent pay decisions without compromising financial control.

How Salary Ranges Are Determined

Salary ranges are determined through a combination of market data, internal role evaluation, and financial constraints.

Market benchmarking

External compensation surveys help establish competitive pay levels for similar roles across industries and geographies. The market median often informs the midpoint of the range.

Role responsibilities and job level

Roles are evaluated based on scope, decision-making authority, and business impact. Higher accountability and complexity justify broader and higher ranges.

Experience, skills, and qualifications

Required expertise, certifications, and skill scarcity influence how wide or narrow a range needs to be to attract and retain talent.

Internal equity

Salary ranges must align across roles and levels to avoid compression and pay inversion. Internal consistency is critical for fairness and workforce stability.

Budget and compensation philosophy

Organizational pay philosophy and affordability ultimately shape final ranges. CFO oversight ensures ranges align with revenue growth, margin targets, and long-term cost sustainability.

When these factors are aligned, salary ranges become a predictable and defensible compensation framework rather than a reactive pay tool.

Also read: AI Compensation Agent: How Enterprises Are Automating Compensation Decisions

Examples of Salary Ranges

Salary ranges vary by role complexity, seniority, and market demand. The examples below illustrate how ranges are typically structured across levels in the US market.

Entry-level role

An entry-level analyst role may have a salary range of $55,000 to $70,000 per year. The minimum typically applies to new graduates or early-career hires, while the midpoint reflects full role proficiency within one to two years.

Mid-level professional role

A mid-level manager or specialist role may fall within a range of $90,000 to $120,000 per year. Employees closer to the midpoint are fully effective in the role, while those near the maximum demonstrate advanced expertise or sustained high performance.

Senior or leadership role

Senior leadership roles often have wider ranges, such as $160,000 to $220,000 per year. The broader spread allows for differentiation based on scope of responsibility, business impact, and strategic influence.

Salary Ranges in Job Postings

Salary ranges in job postings are increasingly used to bring transparency and efficiency into the hiring process.

For employers, publishing salary ranges helps set clear expectations early. It reduces misaligned negotiations, shortens hiring cycles, and limits the risk of offers drifting outside approved compensation boundaries. From a finance standpoint, this improves hiring predictability and protects budget integrity.

For candidates, salary ranges signal seriousness and fairness. They allow applicants to self-select based on compensation fit, which improves candidate quality and reduces offer rejections late in the process.

In some regions, salary range disclosure is also becoming a compliance requirement rather than a choice. CFOs need to account for evolving pay transparency regulations to avoid legal exposure and reputational risk.

When used correctly, salary ranges in job postings act as a governance tool. They align talent acquisition decisions with the organization’s broader compensation and cost management strategy.

Benefits of Using Salary Ranges

Well-defined ranges deliver measurable benefits across both financial management and workforce outcomes.

Cost control and predictability

Ranges create clear limits on compensation spend. They help CFOs forecast payroll costs, plan headcount growth, and manage merit increases without unexpected budget overruns.

Internal equity and consistency

Using ranges reduces pay disparities across similar roles and levels. This lowers the risk of pay compression, employee dissatisfaction, and corrective salary adjustments later.

Stronger governance and compliance

Ranges provide documented justification for pay decisions. This is critical for audits, regulatory reviews, and responding to pay equity or transparency requirements.

Improved retention and performance alignment

Employees gain visibility into earning potential and progression. This supports retention by linking compensation growth to performance and capability development rather than ad hoc increases.

Common Misconceptions About Salary Ranges

Despite their widespread use, salary ranges are often misunderstood across organizations.

“Everyone should be paid at the midpoint”

The midpoint reflects the target pay for a fully competent employee, not a default salary. New hires, developing employees, and high performers should be positioned differently within the range based on role maturity and contribution.

“Salary ranges limit earning potential”

Ranges do not cap performance-based growth. They define role value. Employees who outgrow a range should progress through role expansion or promotion, not unchecked salary increases.

“All companies pay the same for the same role”

Market benchmarks vary by industry, size, geography, and business model. Ranges reflect an organization’s specific compensation philosophy and financial priorities.

“Wide ranges mean poor pay discipline”

Wide ranges can work when supported by strong governance. The issue is not range width, but inconsistent or undocumented pay decisions.

Clarifying these misconceptions helps CFOs reinforce pay discipline while maintaining credibility and trust across the organization.

How Employees Should Interpret Salary Ranges

Employees should view ranges as indicators of role value and growth potential, not as guarantees of immediate pay outcomes.

Placement within a range is typically influenced by experience, skill depth, performance history, and time in role. Employees closer to the minimum are often still developing core capabilities, while those near the midpoint are consistently meeting role expectations.

Movement toward the upper end of the range usually reflects sustained high performance, expanded responsibilities, or specialized expertise. It does not occur automatically with tenure.

For CFOs, clarity on how employees interpret salary ranges is critical. Misalignment can lead to disengagement, unrealistic expectations, and pressure for off-cycle adjustments. Clear communication helps reinforce that salary growth must remain aligned with role scope and organizational affordability.

When employees understand salary ranges correctly, compensation discussions become more objective, structured, and financially sustainable.

Conclusion

Salary ranges provide the structure needed to balance competitive pay with financial discipline. They translate market data and role value into clear compensation boundaries that support consistent decision-making.

For CFOs, salary ranges are a critical lever for controlling payroll costs, maintaining internal equity, and reducing compensation risk. When designed and governed effectively, they improve predictability across hiring, promotions, and annual pay cycles.

Understanding how salary ranges are defined, applied, and interpreted enables finance leaders to partner more effectively with HR while ensuring compensation remains aligned with business strategy and long-term sustainability.

FAQs-

1. What is the difference between a salary range and a salary band?

A salary range defines the minimum and maximum pay for a specific role. A salary band groups multiple roles or levels under a broader compensation range to simplify administration.

2. Should CFOs approve salary ranges or only individual salaries?

CFOs should approve salary ranges as part of compensation governance. This ensures individual pay decisions remain aligned with budget, internal equity, and long-term cost planning.

3. How often should salary ranges be reviewed?

Salary ranges are typically reviewed annually to reflect market movements, inflation, and business performance. High-growth or high-volatility roles may require more frequent review.

4. Can employees be paid above the maximum of a salary range?

Paying above the maximum should be an exception, not a practice. It usually signals role mismatch, retention risk, or the need for re-leveling or promotion.

5. Do salary ranges apply to bonuses and incentives?

Salary ranges apply to fixed pay. Variable pay such as bonuses and incentives is governed by separate performance and incentive frameworks, though both should align to total compensation strategy.